|

徐天媺 May Xu

新泽西州华人贷款专员 New Jersey Chinese Loan Officer

|

USING A LENDER CREDIT TO SUBSIDIZE CLOSING COSTS

Closing costs typically range from 3%-6% of your loan amount. A closing cost estimate priced today for a loan amount of $200,000 was $7,100 (3.55% of the loan amount). In this scenario the client was not paying any points for the interest rate.

The first option buyers have to help with these costs is to ask for the seller to contribute—your realtor will guide you through this part when you’re formulating an offer. Depending on the loan program, sellers are allowed to contribute from 3%-9% of the purchase price towards closing costs, prepaids, and points. I will get into that more specifically in a future post.

Let’s say your seller isn’t contributing towards closing costs, or he/she isn’t contributing enough to cover everything, and you would prefer not to pay for them out of pocket. You still have one other option: the lender credit. Just as you might pay a point (one percent of the loan amount) or two (two percent of the loan amount) for a lower interest rate, you also have the option to go with a higher interest rate and receive a lender credit of a point or two or three to use towards closing costs and prepaids.

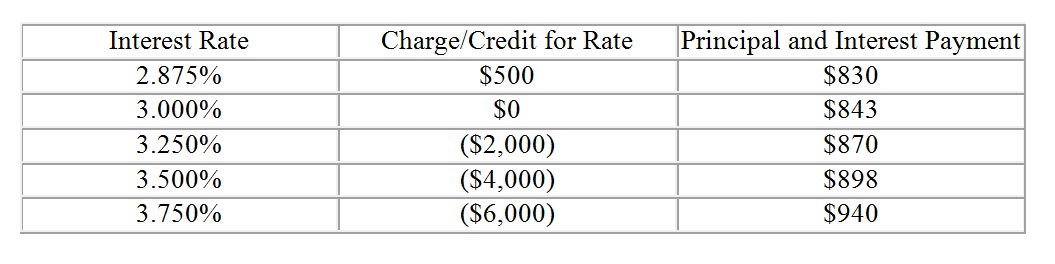

To illustrate this, let’s say the zero point interest rate of the day is 3.00%. Based on a loan amount of $200,000, you might opt to pay ¼ point ($500) for a rate that is .125% lower, or 2.875%. If you wanted a lender credit of a point ($2,000) to use towards closing costs, you might go with a rate that is .25% higher than the par rate, or 3.25%. Two points towards closing ($4,000) might be a rate of 3.50% and three points ($6,000) towards closing might be a 3.75%. Below is an idea of how the different rates would affect your monthly payment:

The first option buyers have to help with these costs is to ask for the seller to contribute—your realtor will guide you through this part when you’re formulating an offer. Depending on the loan program, sellers are allowed to contribute from 3%-9% of the purchase price towards closing costs, prepaids, and points. I will get into that more specifically in a future post.

Let’s say your seller isn’t contributing towards closing costs, or he/she isn’t contributing enough to cover everything, and you would prefer not to pay for them out of pocket. You still have one other option: the lender credit. Just as you might pay a point (one percent of the loan amount) or two (two percent of the loan amount) for a lower interest rate, you also have the option to go with a higher interest rate and receive a lender credit of a point or two or three to use towards closing costs and prepaids.

To illustrate this, let’s say the zero point interest rate of the day is 3.00%. Based on a loan amount of $200,000, you might opt to pay ¼ point ($500) for a rate that is .125% lower, or 2.875%. If you wanted a lender credit of a point ($2,000) to use towards closing costs, you might go with a rate that is .25% higher than the par rate, or 3.25%. Two points towards closing ($4,000) might be a rate of 3.50% and three points ($6,000) towards closing might be a 3.75%. Below is an idea of how the different rates would affect your monthly payment:

So, what should you do? Pay more upfront for closing costs or go with a higher rate and cover some of them with a lender credit? The answer depends on your personal situation and how soon you could breakeven on monthly payment difference. Would you like to get $6000 credit at once or you would rather choose the lower rate (3.5%) with $42 payment saving which will cost 11.9 years to save you $6000 in total? The answer is up to you.

FHA Lender Credits are a Cost-Effective Bargain: Federal Housing Authority (FHA) financing is a great option for many buyers, particularly those unable to meet the more stringent down payment and higher credit score requirements of conventional financing. FHA loans offer competitive, low 30-year fixed rates and allow for supporting income from a family member to qualify. But FHA loans carry significantly higher closing costs. One way to offset the increased costs is to take a lender credit in exchange for a slightly higher interest rate. While choosing a higher rate may seem counter intuitive, some borrowers may need help to cover closing costs and even those who don't may consider the exchange a bargain.

FHA loans fall into two categories: conforming loans up to $417,000, and FHA jumbo loans that range as high as $729,750, depending on a given county's set limit. Down payments as low as just 3.5% are accepted on both and the reason challenged borrowers get the best terms is because FHA loans carry mortgage insurance funded by one-time premiums and the on-going monthly mortgage insurance payments that the borrower is charged. The one-time, Upfront Mortgage Insurance Premium (UFMIP) currently amounts to 1.75% of the base loan. So the charge on a $729,750 loan will cost around $12,770. This FHA fee can be financed by being added to the base loan, but the cost is there nonetheless.

A loan's closing costs are divided into Non-Recurring Closing Costs (NRCCs) and Recurring ClosingCosts (RCCs).

Borrowers with limited funds to cover closing cost may consider a lender credit in exchange for a nominal rate increase as an attractive solution. On a loan of $729,750 supporting a purchase price of $756,000, the combined closing costs -after factoring in lender fees, title fees, the FHA's UFMIP, 14 months' hazard insurance premium, 8 month's property taxes, pre-paid mortgage interest, etc. -could potentially runas high as $30,000. Depending on pricing at the time a loan is locked, a nominal rate increase could offer credits of over $20,000 and makethe purchase a tenable proposition for the buyer.

FHA Lender Credits are a Cost-Effective Bargain: Federal Housing Authority (FHA) financing is a great option for many buyers, particularly those unable to meet the more stringent down payment and higher credit score requirements of conventional financing. FHA loans offer competitive, low 30-year fixed rates and allow for supporting income from a family member to qualify. But FHA loans carry significantly higher closing costs. One way to offset the increased costs is to take a lender credit in exchange for a slightly higher interest rate. While choosing a higher rate may seem counter intuitive, some borrowers may need help to cover closing costs and even those who don't may consider the exchange a bargain.

FHA loans fall into two categories: conforming loans up to $417,000, and FHA jumbo loans that range as high as $729,750, depending on a given county's set limit. Down payments as low as just 3.5% are accepted on both and the reason challenged borrowers get the best terms is because FHA loans carry mortgage insurance funded by one-time premiums and the on-going monthly mortgage insurance payments that the borrower is charged. The one-time, Upfront Mortgage Insurance Premium (UFMIP) currently amounts to 1.75% of the base loan. So the charge on a $729,750 loan will cost around $12,770. This FHA fee can be financed by being added to the base loan, but the cost is there nonetheless.

A loan's closing costs are divided into Non-Recurring Closing Costs (NRCCs) and Recurring ClosingCosts (RCCs).

Borrowers with limited funds to cover closing cost may consider a lender credit in exchange for a nominal rate increase as an attractive solution. On a loan of $729,750 supporting a purchase price of $756,000, the combined closing costs -after factoring in lender fees, title fees, the FHA's UFMIP, 14 months' hazard insurance premium, 8 month's property taxes, pre-paid mortgage interest, etc. -could potentially runas high as $30,000. Depending on pricing at the time a loan is locked, a nominal rate increase could offer credits of over $20,000 and makethe purchase a tenable proposition for the buyer.

Why close at the end of the Month?

Mostly, this has to do with lowering your out of pocket costs by minimizing the amount of "prepaid interest" you pay on your mortgage at closing.

Interest on your mortgage begins running from the date your transaction closes, but most loans are due on the first day of the month. So when you close, you "pre-pay" the interest between the closing date and the end of the month. 阅读全文

Mostly, this has to do with lowering your out of pocket costs by minimizing the amount of "prepaid interest" you pay on your mortgage at closing.

Interest on your mortgage begins running from the date your transaction closes, but most loans are due on the first day of the month. So when you close, you "pre-pay" the interest between the closing date and the end of the month. 阅读全文

The Complete Guide to ARM Loans - 3, 5, 7 & 10 Year

What Is an ARM? An adjustable-rate mortgage, or ARM, has an introductory interest rate that lasts a set period of time and adjusts annually thereafter for the remaining time period for a total of 30 years. After the set time period your interest rate will change and so will your monthly payment. The monthly payment amount is usually subject to a cap. 阅读全文

What Is an ARM? An adjustable-rate mortgage, or ARM, has an introductory interest rate that lasts a set period of time and adjusts annually thereafter for the remaining time period for a total of 30 years. After the set time period your interest rate will change and so will your monthly payment. The monthly payment amount is usually subject to a cap. 阅读全文

Loan Characteristics and Their Effect on Your Prospective Investment Project

Most real estate investors acquire income properties by obtaining a loan. As you are probably aware, maximizing loan funds (or OPM—Other People’s Money) maximizes leverage and, thus, maximizes returns. The right loan product can easily make or break a real estate investment deal. As such, exploring various loan characteristics is more than warranted. 阅读全文

Most real estate investors acquire income properties by obtaining a loan. As you are probably aware, maximizing loan funds (or OPM—Other People’s Money) maximizes leverage and, thus, maximizes returns. The right loan product can easily make or break a real estate investment deal. As such, exploring various loan characteristics is more than warranted. 阅读全文

Using a Lender Credit to Subsidize Closing Costs

Closing costs typically range from 3%-6% of your loan amount. A closing cost estimate priced today for a loan amount of $200,000 was $7,100 (3.55% of the loan amount). In this scenario the client was not paying any points for the interest rate. 阅读全文

Closing costs typically range from 3%-6% of your loan amount. A closing cost estimate priced today for a loan amount of $200,000 was $7,100 (3.55% of the loan amount). In this scenario the client was not paying any points for the interest rate. 阅读全文

Why debt to income ratio matters in mortgage?

Paying your bills on time, having stable income and boasting a good credit score won't get you a mortgage loan if your lender determines that you live too close to the edge. In the mortgage lending world, your distance from the edge is measured by your debt-to-income ratio, which, simply put, is a comparison of your housing expenses and your monthly debt obligations versus how much you earn. 阅读全文

Paying your bills on time, having stable income and boasting a good credit score won't get you a mortgage loan if your lender determines that you live too close to the edge. In the mortgage lending world, your distance from the edge is measured by your debt-to-income ratio, which, simply put, is a comparison of your housing expenses and your monthly debt obligations versus how much you earn. 阅读全文

The Bi-Weekly Mortgage - Who Needs It?

Normally, you make twelve mortgage payments a year. Since there are fifty-two weeks in a year, a bi-weekly mortgage equals 26 half-payments a year. The equivalent would be making thirteen mortgage payments a year instead of twelve. By applying that extra payment directly to the loan balance as a principal reduction, your loan amortizes more quickly, requiring fewer payments. 阅读全文

Normally, you make twelve mortgage payments a year. Since there are fifty-two weeks in a year, a bi-weekly mortgage equals 26 half-payments a year. The equivalent would be making thirteen mortgage payments a year instead of twelve. By applying that extra payment directly to the loan balance as a principal reduction, your loan amortizes more quickly, requiring fewer payments. 阅读全文

More Articles

Chinese speaking realtor, mandarin speaking real estate agent, Chinese speaking loan officer, Chinese speaking attorney,

New Jersey, Jersey City, Hoboken, Weehawken, Fort Lee, West New York, Edison, Summit, Short Hills, Millburn

New Jersey, Jersey City, Hoboken, Weehawken, Fort Lee, West New York, Edison, Summit, Short Hills, Millburn